Money money money doesn’t feel all that funny when you’re trying to cover your monthly bills and save enough to retire this century. To start, you’ll need a budgeting plan. Well, one besides crossing your fingers whenever you check your accoount balance.

Luckily, there’s an app for that! Actually, quite a few. Budgeting apps can help you keep your finances on track and your goals in line. All of the apps are slightly different, but generally they offer useful functions like:

- Connecting your accounts so you don’t have to track your money manually.

- Calculating your spending and savings goals.

- Alerting you when you’re going over budget.

Still sound a little overwhelming? No need to worry – we’re here to help! Below, we break down a bunch of the best budgeting apps depending on your spending and saving goals.

That should help you choose the one that’s right for you. So delete a few pictures of your pets to free up some storage on your phone, and let’s get started!

Quick note: we are not financial advisors. The information provided on this page is for educational purposes only.

The 6 Best Budgeting Apps to Help You Save Money

1. Mint

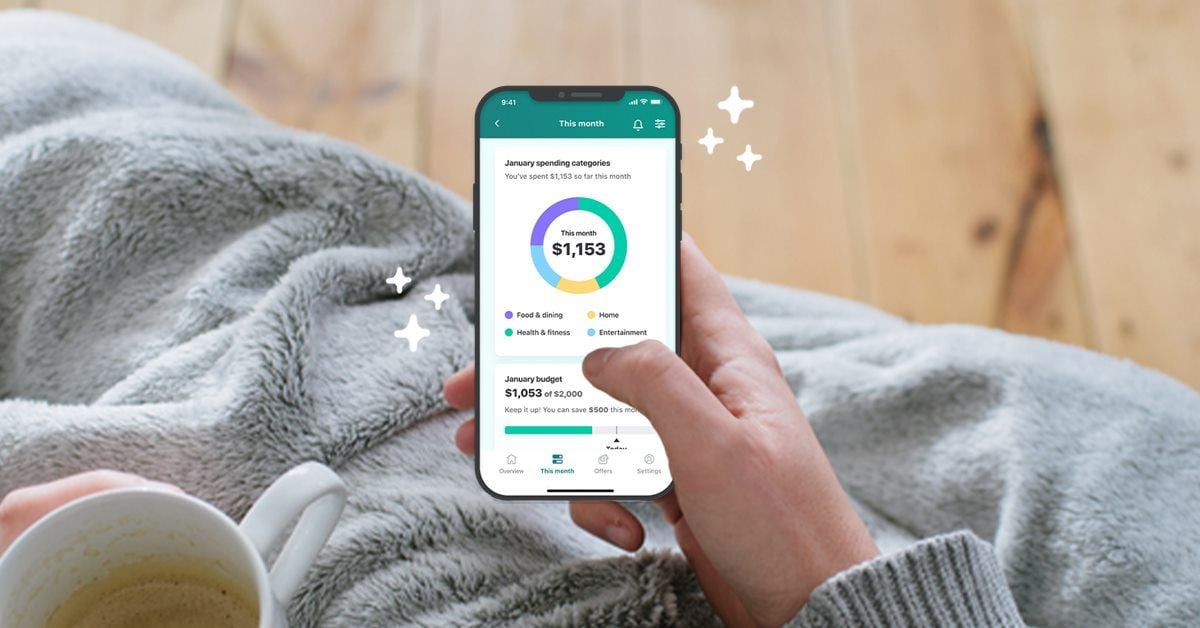

Mint allows you to connect your bank, credit cards, loan, savings accounts, and investment accounts to track your spending and savings. With this app, you can make a custom budget with personalized categories. Just because your roommate prioritizes a budget for crystals, it doesn’t mean you have to.

The app also monitors your spending, including a subscription manager that tracks the hundreds of services you’re subscribed to. That monthly shipment of plant sweaters was fun for a while, but Fernie Sanders can probably live without it.

Best budgeting app for: First time budgeters who need a place to start.

App price: This app is free, the best savings of all.

Get the app: Available on Apple App Store and Google Play Store.

2. YNAB

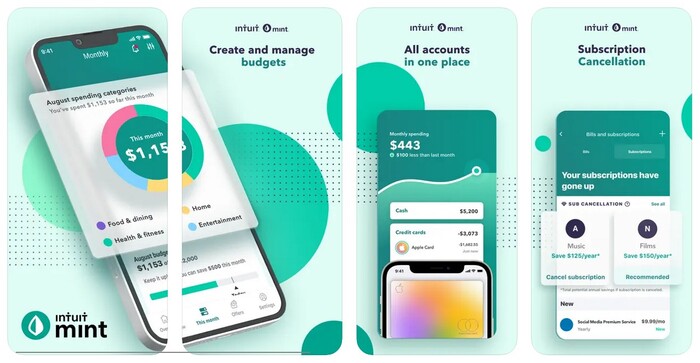

YNAB stands for “You Need a Budget.” And if you’re reading this list, they’re probably right. YNAB is part budget tool, part financial philosophy, and 100% an acronym. It’s based on four rules:

- Give every dollar a job by deciding what you’ll use it for as soon as you get it.

- Embrace your true expenses. Plan for large expenses, like a car problem, by breaking it down into monthly payments.

- Roll with the punches. Your budget won’t burst into flames if you overspend in one category, because the app will help you find another category to cover it.

- Age your money. The app helps you plan to cover this month’s upcoming bills with last month’s money, so you’re not living paycheck to paycheck.

Best budgeting app for: Savers who want to upgrade their budgeting to the next level.

App price: The app is a $14.99 monthly or $99 annual fee, but they offer a 34-day free trial.

Get the app: Available on the Apple App Store and Google Play Store.

3. Personal Capital

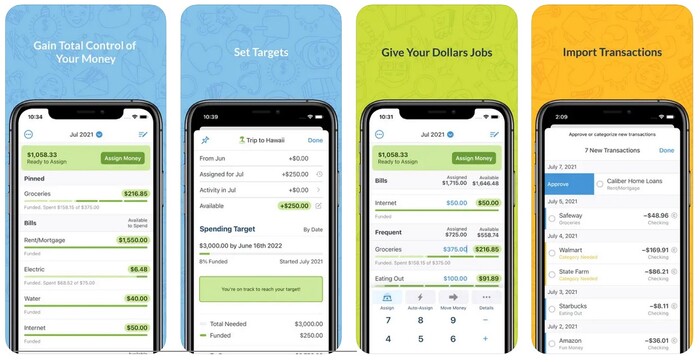

Once your budgeting plans go from “get to a positive number” to “I have more money than I can fit under my mattress,” it’s time to start investing. In the money market, that is. Not a thicker mattress.

Personal Capital is an app by Empower that tracks all of your financial accounts and calculates your net worth. It compares your investments to their recommendations and provides Investment Checkups to keep you on track. It will even analyze your mutual fund fees to make sure you’re getting the best bang for your invested buck.

You might as well get a pinstripe suit now for your inevitable Wall Street takeover. Just add it to the budget!

Best budgeting app for: Newbie investors who just found out “net worth” doesn’t only apply to finance bros.

App price:The app is free to use, but gives you the option to add human, non-robot investment management services for accounts over $100,000.

Get the app: Available on the Apple App Store and Google Play Store.

4. Honeydue

Once you start sharing personal finances with your sweetie, all of your financial decisions suddenly have another set of eyes. They might start asking questions like, “Do we need take-out for the fifth time this week?” and, “Will this Beanie Baby investment portfolio ever pay off?”

Honeydue gives you the tools to share a budget with a boo. It lets you maintain your own separate accounts and control what financial information the other person sees. You can create joint financial goals, set bill payment reminders, and split or assign expenses.

The app also gives you the option to open a joint account with a debit card for joint spending. You know, for that takeout!

Best budgeting app for: Couples who think “Love is Blind” shouldn’t apply to finances.

App price: The app is free to use.

Get the app: Available on the Apple App Store and Google Play Store.

5. Goodbudget

Many old school budgeters use the envelope method, also known as Kakeibo, which is Japanese for “household account book.” In this system, you put physical cash into different envelopes, so you have to physically take the money out to spend it and you can actually run out.

But nowadays, many expenses have to be paid online. And, having cash envelopes can feel like being the grandma writing a check at the grocery store. Goodbudget takes the envelope system digital by creating digital envelopes for you to sort your spending.

You can thank them when your budget starts to fall into place, and for the fact that you don’t have to find a place that still sells envelopes. We think it’s called the poastle stoar?

Best budgeting app for: Old school budgeters forced to live in a cashless world.

App price: The basic version is free, or you can upgrade to Goodbudget Plus for $7/month.

Get the app:Available on the Apple App Store and Google Play Store.

6. PocketGuard

PocketGuard is a simple budgeting app that helps you manage your cash flow and spending habits. Link your accounts and bills so you can see everything you spend money on. The app calculates which expenses are sucking your accounts dry. Which ironically, for us, is often our skin moisturizing routine.

PocketGuard calculates your spending limits and allow you to set spending alerts so you don’t blow it all in one place. You won’t be able to stop that FICA guy from taking all your money, but you may find other areas where you can cut back.

Best budgeting app for: Spenders who can’t keep their credit card in their pants.

App price: The basic version of the app is free; you can upgrade to PocketGuard Plus for $7.99/month–if your spending limits allow.

Get the app: Available on the Apple App Store and Google Play Store.

- 15 Tips to Stop Spending Money, According to the Experts - January 25, 2023

- The 6 Best Budgeting Apps to Get (and Keep) That Money, Honey - January 11, 2023

- 15 Realistic Ways to Save Money, According to the Experts - January 5, 2023

Leave a Comment