If you thought crypto was complicated, Decentralized Finance is the calculus to its algebra. Or the Ancient Greek to French. Or something that involves learning that isn’t done through TikTok.

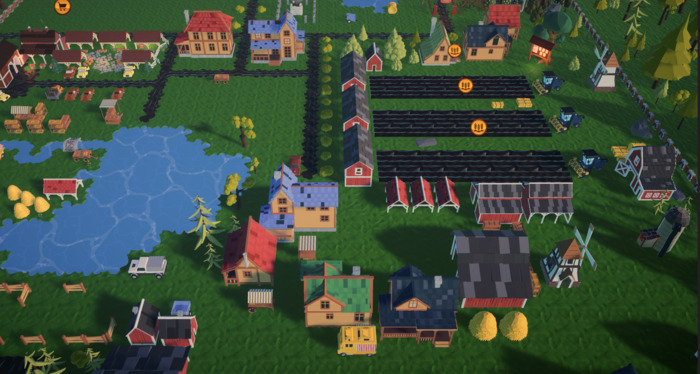

The Solana-based project DeFi Land makes yield farming feel more like a game than a complicated investment approach. It’s kind of like Farmville, but you earn actual money.

Anonymous founders launched the public beta version of DeFi Land at the end of 2021. The game is officially a “multi-chain agriculture simulation web game created to gamify decentralized finance.” If you read that sentence and fully grasped what we were talking about, you are clearly ahead of the game.

Everyone else, please grab a snack and have a seat. We’ll walk you through what Decentralized Finance and Yield Farming are, which will help explain how DeFi Land works.

Just, keep in mind, this is not investment advice.

What is Decentralized Finance?

Decentralized Finance, or DeFi, is the process of conducting financial transactions through peer-to-peer networks. The transactions happen on the blockchain via a distributed database that verifies it using a consensus mechanism.

This means you can lend, trade, or borrow cryptocurrency from a company or a person without a bank involved. It does expose holders to risk, but the prospective returns are higher.

For instance, if you’ve ever sent money via a wire service from your bank to someone else, you know it’s not cheap or fast. Because, sure that Zelle transaction might go through immediately, but sending money to someone in another country?

Chase‘s official site says “international wire transfers can take between 1-5 business days. Wire transfer times may also vary depending on designated cut-off times, federal regulations, as well as weekends and bank holidays.”

Using DeFi, you can send coins from your crypto wallet to someone else’s any time of the day or night and the transaction usually processes within minutes or hours. And, depending on which blockchain you’re sending it on, the fees are relatively low.

What is Yield Farming?

Yield farming is any type of blockchain protocol that allows people who hold some crypto tokens to ‘lock up’ those holdings with a protocol so that in return, they distribute rewards. These rewards will be shared as protocol governance tokens.

In simpler terms, rather than letting your crypto assets just hang out in your wallet, you can invest them to get potentially good returns. You put in two coins and get a token back while the DEX holds your coins and they collect interest.

In comes DeFi Land, which gamifies yield farming and other aspects of DeFi.

What is DeFi Land?

DeFi Land is an agriculture simulation game that makes decentralized finance feel more accessible. It does this by turning investment activities into fishing, farming, carnival games, and more. But the main focus on the game is on yield farming. By buying “seeds” and planting them as crops, you can grow money. Or again, for the people in the back, lose money.

Because, while the gamified, visual approach makes DeFi Land easier to comprehend in some ways, it doesn’t remove the need for doing your own research. You still need to choose coins that are more likely to be profitable versus those just selecting those that have the highest return.

The project also offers free-to-play educational tutorials if you want to explore DeFi in more depth without risk.

How Do You Make Money In DeFi Land?

To use DeFi Land, you’ll need a Solana wallet like Phantom or Sollet. Once you do, connect your wallet with the game. After this, you’ll have access to the two primary ways you can make money in the game: through yield farming and staking.

1. Yield Farming

One of the things DeFi Land does very well is make yield farming feel straightforward. Within the game, the Farm Board shows the interest you’d earn on a coin pair and what coin you would be paid out in. It’s important to check this before you go to the Market, because the rates vary wildly (from 8% to over 300%) and it helps to know what coin pairs are in demand.

Once you know the pair you want to create, go to the Market and trade a coin you have for the coins you need. Then, take those to the Seed Laboratory and create “seeds” from these.

If you’re familiar with how yield farming typically works, the Seed Laboratory is where you lend a Decentralized Exchange (DEX) your coins and provide liquidity to a pool. In return, you get a token that you hold. In the game, these are your seeds.

You then take these seeds, plant them, and watch them grow dragon fruit, potatoes, strawberries, and other plants. You can harvest the returns — literally, there’s a tractor for this — and then use those to create more seeds and increase your gains.

🚜👨🌾 Are you even a real farmer if you can't manage fuel, traffic, supply and demand while harvesting your crops? 👀You better get yourself a Gen-0 harvester NFT and be ready.

1⃣1⃣ Days left! pic.twitter.com/OIsoVrP7ui

— DeFi Land (@DeFi_Land) May 5, 2022

But farming isn’t without its risks. If you, say, trade Solana for a high-risk coin and that coin tanks, you’ve probably just lost money. Even if your return on that coin was 250%.

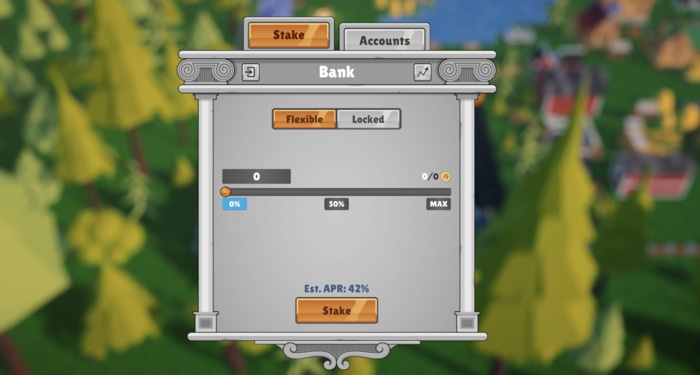

2. Staking

Staking in DeFi Land is straightforward, but at this time, you can only stake the game’s token, DFL. You can stake any DFL you earn through yield farming or that you’ve traded other coins for in the Market. At press time, the interest rate you’d earn on DFL at the in-game Bank was 42%.

More features are on their way as well. According to the DeFi Land whitepaper, the ability to sell land, rent NFTs, and more, are all on their roadmap, as is a robotic farming feature. This will let users “stake their LP tokens (seed tokens) into Robotic Farms that automatically harvest and reinvest to maximize returns.”

Leave a Comment