Nowadays, the prices are giving Saint Laurent, but the paychecks are giving Shein. You need your money to go farther, work harder, and…be more. As we head into what seems to be a recession, it can feel impossible to pay your bills, let alone save up for retirement, assuming the world hasn’t descended into Mad Max: Fury Road by then.

That’s why we talked to the experts about how to save money. They gave us tips on how to spend less and ways to save money to build long-term wealth.

How to Save Money, According to the Experts

1. Check on Your Money Weekly

When you’re starting to save, it can feel fruitless to go check on that tiny number in your savings account. But if you want that number to get any bigger, you’ll need to confront it regularly.

“I encourage you to check in weekly with your money,” says Patrice Washington, financial expert and host of Redefining Wealth TV. “Many people spend without tracking their finances. If you intentionally set aside time each week to focus solely on your money, you’ll recognize spending patterns and habits that you can address.”

You can easily check on your money using a budgeting app like YNAB (You Need a Budget) or your bank’s app.

2. Make It Difficult for You to Access Your Savings

If you can’t get your money, you can’t spend it. Keep your emergency fund out of reach so you’re not tempted to classify “didn’t get Eras tour tickets” as an emergency.

“Make it inconvenient to access your savings funds,” says Todd Christensen, AFCPE-accredited financial counselor and education manager at Debt Reduction Services, Inc. “Have your savings deposited directly from your employer into an account at a financial institution away from your checking account. Don’t connect the two accounts. Don’t get an ATM card for your savings.”

3. Don’t Plan to Just Save the Leftovers

In a perfect world, you would spend only what you need and the rest would go in the savings account. But, if your only savings plan is to save what you have at the end of the month, you probably won’t save anything.

“The reality is that most households spend whatever is in their paycheck and their checking account,” says Christensen. “Successful savings happens at the beginning of the month.” Once you know what you need to cover your bills for the month, transfer some into savings.

If your income and bills are about the same each month, consider setting up a recurring deposit that happens automatically every month. It doesn’t have to be huge. Even $25 per paycheck is a good start.

4. Spend Money on What You Actually Want

“Getting crystal clear on your values helps to shine a light on what you should spend on, and then you can see that everything else is a waste of your hard-earned money,” says Kari Lorz, certified financial education instructor and owner of Money for the Mamas.

“For example, my husband and I value family vacation trips. To make those expensive vacations work, we identified and decided that driving older cars is a way to balance the budget,” says Lorz. “I drive a 2007 Subaru with 175,000+ miles on it, and I couldn’t care less. My car is not important to me.”

Pick what you actually want to spend money on and cut back on things that don’t bring you joy. If you love design and driving, maybe that is a fancy car. But, if you don’t, consider a more budget-friendly car.

The same goes for your phone. Do you need the latest model? Or are your current model’s photo-taking capabilities good enough for another year?

5. Literally Touch Cash

“Take your monthly paycheck in physical cash from the bank at the start of each month and divide it into different envelopes. Each of these envelopes needs to stand in for one of your financial goals,” says Bruce Mohr, senior investment advisor at Fair Credit.

This can help you visually confront the fact that you are taking away from your vacation fund to buy your third iced coffee today. Mmmm caffeine.

6. Focus on the Big Expenses

You’ve stopped getting your morning lattes and eating avocado toast, yet you have not magically become a billionaire. What gives?

“One piece of advice I hate hearing is that you should focus on reducing small expenses. Trimming out trips to your local coffee shop will only take you so far,” says Forrest McCall, personal finance expert and founder of Don’t Work Another Day.

“Reducing your housing, food, and transportation costs can save you thousands per month. Because these expenses can cost you thousands each month, even if you can slightly reduce them, it can make a huge impact on your finances.” When it come to food, take a look at your grocery and restaurant spending. As well as those $15 sandwiches that cost you $30 to have delivered.

7. Ask to Pay Less

“A money saving tip that is often overlooked is to negotiate your bills and expenses,” says Zach Ross, a financial coach. “For example, you might be able to negotiate a lower interest rate on your credit card, or a lower monthly payment on your rent or mortgage. It never hurts to ask, and you might be surprised at how much you can save by doing so.”

8. Transfer Your Credit Card Balance

Credit cards generally have high interest rates, so it costs money while you work on paying them off. Pretty rude of credit card companies to make you pay for the opportunity to pay them later.

“Consider transferring your current balance to a 0% balance transfer card which will waive interest charges on that balance for a promotional period of 12-21 months. This will buy you more time to pay off your debt without additional interest fees adding to the payment, which will save you a lot of money and help you get off debt faster,” says Andrea Woroch, money saving expert.

9. Get a Credit Card That Gives You Cash Back

“Data collected from Gigapoints found that people miss out on $1,000 worth of cash back by using the wrong credit card,” says Woroch. “It’s important to find a cash back card that matches your spending style,” says Woroch. “Otherwise, go with a flat-rate cash back card. This will help you earn more money back no matter what types of purchases you make.”

If you only eat chicky nuggets, there’s no point in having a credit card that gives rewards for restaurant spending.

10. Save Money on Your Phone Plan

When’s the last time you went to the phone store? You probably buy your phones and manage your plans online, so why pay the phone company’s rent? You have your own rent to worry about.

“You could cut your monthly wireless spending significantly by moving to an online-only wireless carrier like Mint Mobile which sells service in bulk so you can get a 12-month plan with talk, text and data for just $15 a month,” says Woroch.

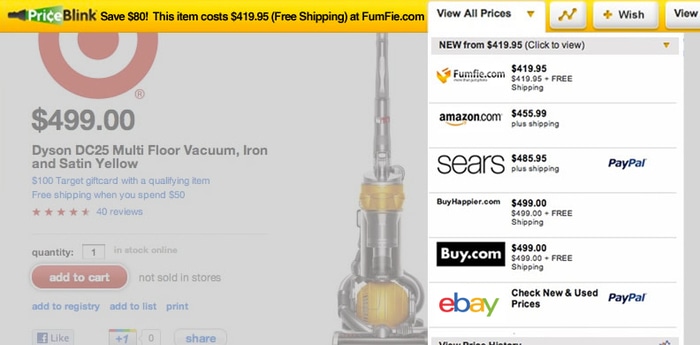

11. Use Browser Savings Tools

You don’t need to be an extreme couponer to get the best deals on your shopping. Which is good, because our scissor hands are tired.

“Spending time hunting for bargains may not sound appealing to you. But, you don’t have to put in a lot of time or effort thanks to a few browser tools that do all the savings for you!” says Woroch. “Download CouponCabin’s Sidekick tool which automatically applies coupons at check out for you and even cash back when shopping online so you never miss out on a deal. Meanwhile, PriceBlink provides instant price comparison so you find the cheapest buying options from hundreds of online retailers quickly.”

12. Track Sales Cycles

“The key to saving at big-name stores is doing your research and knowing the store’s sales cycle. Stores often follow the same calendar of sales each year, so make note of any sales for your favorite retailers and save your shopping trip until then (if you can wait),” say Rebecca Gramuglia, consumer expert at TopCashback.com.

We all know about Black Friday and Cyber Monday, but there are many more than that, as Gramuglia points out. “Nordstrom hosts their Anniversary Sale event every year beginning in mid-July. And Sephora historically hosts their Savings Event once in the spring and once in the fall.”

13. Keep Shopping Around

“Most of us shop around for the best deals on monthly servicer providers, insurance, and wireless service when we first sign up, but don’t spend the time a year or two later to do that again,” says Woroch. “Even if prices don’t go up, you could be missing out on cheaper service options from competitors. Spending just a little time to search can offer huge savings that can give you some breathing room in your budget.”

For example, an analysis by NerdWallet found that drivers miss out on saving $416.52 a year on average nationwide by not shopping around for car insurance. You don’t need a gecko to tell you that.

14. Start a Side Hustle

You can Scrooge until you’re trying to charge visiting ghosts rent. But let’s be honest, it’s easier to save when you have more cash coming in.

“Looking for ways to make more money is your ticket to financial freedom!” says Woroch. “You can offer virtual tutoring on nights and weekends for around $20/hour via Tutors.com or make up to $1,000 a month by pet sitting via Rover.com.

15. Examine Your Monthly Subscriptions

“You could be wasting money on bills in the form of unnecessary add-ons, extra services you don’t need or use, and forgotten subscription services. So spend some time scrutinizing your monthly bills for savings,” says Woroch.

Look at your monthly subscriptions and let go of the ones that are sucking the life out of your monthly budget. Make sure to check the ones you’re subscribed to on via your phone as well.

- 15 Tips to Stop Spending Money, According to the Experts - January 25, 2023

- The 6 Best Budgeting Apps to Get (and Keep) That Money, Honey - January 11, 2023

- 15 Realistic Ways to Save Money, According to the Experts - January 5, 2023

Leave a Comment