Making a budget is hard enough. But making a budget and sticking to it? That’s the real challenge. It can feel like your wallet is constantly under attack, wit prices going up for essentials like groceries, gas, and fun little outfits. So, to keep your budget under control, you need to know how to stop spending money.

We went to the experts for their best tips and tricks to spend less. Unfortunately, they wouldn’t lock away our wallets and swallow the key, but they did have other ideas.

Try out these tips when you’re ready to save up and keep your cash from flying out the window as fast as it arrives.

15 Tips to Stop Spending Money

1. Track Your Spending

This piece of advice can feel about as helpful as getting told to “just relax” during a panic attack. But, like those hot girl mental health walks, we regret to inform you that this advice actually works.

“Time and time again, people scoff when you tell them to start tracking their spending. They think it’s silly, and it won’t help. But honestly, it does!” says Kari Lorz, certified financial education instructor and owner of Money for the Mamas.

“When you realize how much you’re spending on (insert your guilty pleasure here) in a month, you’ll be shocked. Once you realize the total impact of your habit, you’ll automatically take action to reduce the habit.”

2. Hide Your Savings

“Keep your savings funds in a bank account or credit union separate from your checking, and don’t connect them. If you make it inconvenient to get to your money in savings, you’re less likely to make impulsive purchases you know you could pay for with your savings funds,” says Todd Christensen, AFCPE-accredited financial counselor and education manager at Debt Reduction Services, Inc.

Hide your emergency fund because you can’t spend what you can’t see. And it’s easier than shopping with a blindfold.

3. Pay Yourself First

Going on a spending freeze can be as effective as that no carb, no fat, no sugar diet that you quit on January 3rd. You need to start realistic spending habits by planning for saving and spending.

“I am a huge fan of the ‘Pay Yourself First’ method,” says Lorz. “Figure out your monthly budget and determine how much you can comfortably save. Then set up an automatic transfer to happen the day after payday, and send that money to your savings. There, your money is gone, safely tucked away in your savings account. You can’t spend what’s not there.

The key is to make it automatic; it will take you less than five minutes to set up, and then it works on autopilot. Saving you money month after month, and you don’t have to do a thing.”

4. Do a Money Challenge

Spending money is fun. But not as fun as winning, because you don’t get to rub your spending in anyone’s face. If you’re the problem on family game nights, put that competitive spirit towards a spending challenge.

“You can do a no-spend month, a no-spend week, a no-dining out month, etc. People love competition, even when it’s with themselves. Try and do what you think you can’t; you’ll find creative ways to make things work,” says Lorz.

“You might learn that you really don’t need that $12 sandwich every day for lunch. You might learn that you have $78 in unused gift cards hiding in your junk drawer. You might find that you never really watched Hulu anyways.”

5. Use the 10/10/10 Rule

Buying some things from the Target Dollar Spot feels good in the moment. But how will you feel about owning 45 tumblers when it’s time to move? Ask how your future self will feel about the purchase before you make it.

“How will this purchase make me feel in 10 minutes, 10 months, 10 years? Almost all purchases will feel great in 10 minutes. After 10 months, you probably won’t care that you spent the money on that purchase.

But when you look at it from 10 years out you will probably regret the purchase and realize you could live without it,” says Zach Ross, a financial coach.

6. Leave Yourself a Note

We like to call this next tip a money mood board. Slightly less sexy than creating a new apartment aesthetic (cats; the aesthetic is cats), but still just as effective!

“On a business card-sized piece of paper, write down your top three most meaningful financial goals. Then, place that card in front of your credit card, debit card, or cash so you have to see if every time you think about making an unplanned purchase,” says Christensen. “It forces you to acknowledge your own priorities.”

7. Avoid Shopping Centers

“Avoid shopping centers!” says Bruce Mohr, senior investment advisor at Fair Credit. “Avoiding stores was my weapon of choice when I was trying to cut back on my expenditures. I spent far too many Saturdays idly roaming around Costco and loading my cart with unnecessary items.”

As the name would imply, shopping centers are designed to get you to spend more than you planned. Avoid them and stick to…fiscal responsibility centers? Okay, or maybe a nice park.

8. Don’t Buy from Social Media

Not everything you see on the Internet is real, and not everything you see on social media is worth buying. No matter how many cool filters it has on it.

Instagram is full of ads and influencers trying to influence you into spending. Now you have 23 sparkly phone cases even though you only have one phone. Steer clear of social media micro-trends that you’ll be bored with by next week.

9. Get That Paper, Not Plastic

“Stop carrying plastic around in your wallet or purse. Studies show that we spend 12%-15% more with plastic than we do with cash,” says Christensen.

Your credit card bill is Future You’s problem, and you don’t even know her. But trust us, she’ll thank you if you spend less, if not for the Spicy Cheetos you ate.

10. Delete Your Payment Info

“Delete payment details in retail accounts (like Amazon!) and delete shopping apps from your phone,” says Andrea Woroch, money-saving expert. “It’s so easy to buy things you don’t need and without thought when all you have to do is click the buy button, so take steps to make it more challenging to do so.”

Once you have to get up and grab your wallet from the other room, you may decide spending isn’t worth the hassle. If you have your credit card number memorized, maybe you can get that Eternal Sunshine of the Spotless Mind procedure to erase it from your brain. Or cram a few more numbers of pi in there.

11. Don’t Shop Just Because There’s a Sale

Look, we’ve all done “shopping math” when it comes to sales. But no matter how many equations you plug into the process, it’s not worth it.

You’re not saving money with a 50% off sale because you’re still paying 100% more than you planned. Don’t buy something from a sale unless you were already planning to buy it.

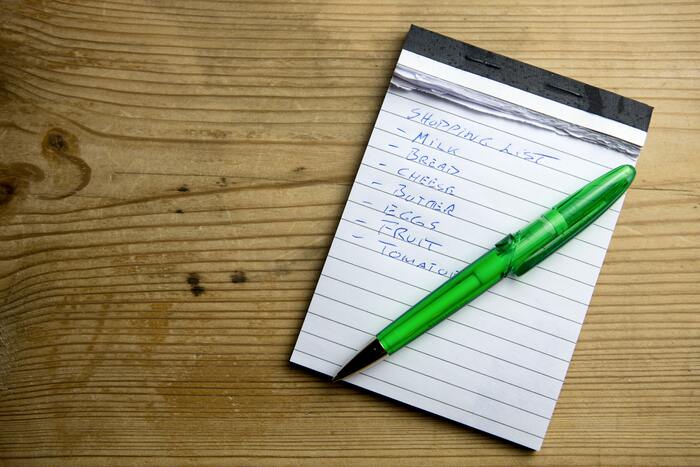

12. Make a Shopping List

Go into the store with a plan. If you already know exactly what you’re getting – maybe even down to the brand – you’ll be less tempted to buy the farm-raised organic truffle almond caviar.

And of course, don’t go grocery shopping when you’re hungry. If you’ve ever walked into a Trader Joe’s before dinner, you know exactly what we mean.

13. Buy Food You Want to Eat

Look at that sad bag of mixed greens in your crisper door – it’s dying! You don’t need to have a super healthy meal plan to save money on food. Just buy food you’ll actually want to eat. And then, you know…eat it.

Easy-to-make or even prepared food from the grocery store is still less than the benjamins GrubHub charges for delivery when you have nothing you want in the fridge. So make sure your kitchen is stocked so your wallet can stay stocked, too.

14. Carry a Basket

“Use a hand basket and self check out to limit impulse purchases. When running into the grocery store or Target for a few quick items, using a basket will deter you from adding unnecessary items and you won’t have room to lug around extra items you don’t need,” says Woroch.

Because it doesn’t matter how much you can lift at the gym. A basket gets a whole lot harder to move around than a cart with wheels. Your biceps have been looking great, though!

15. Pretend to Shop

Shopping is fun, which is why we can’t stop doing it. So, scratch the online shopping itch by pretending to shop. Browse houses on Zillow you can never afford and create a Pinterest board to furnish it.

You’re unlikely to get approved for a $250 million mortgage, so this is a pretty risk-free pastime. That is, not until after you put these spending tips to use.

- 15 Tips to Stop Spending Money, According to the Experts - January 25, 2023

- The 6 Best Budgeting Apps to Get (and Keep) That Money, Honey - January 11, 2023

- 15 Realistic Ways to Save Money, According to the Experts - January 5, 2023

Leave a Comment