If you thought that bonds were just the stuffy Christmas present from Grandma that you tossed aside in favor of the much more interesting new LEGO set from Santa, they are.

But, Series I Savings Bonds are the one type that you’ll be happy to get… along with the LEGO Millennium Falcon. We’ll tackle the rising costs of those in another post. And, just a reminder, this is not investment advice.

What Are I Bonds?

Series I Savings Bonds are savings bonds issued by the U.S. Treasury Department. They were launched in September 1998, along with Shakespeare in Love and Armageddon.

Unlike fixed rate bonds, Series I Bonds earn a composite rate that is a combination of a fixed interest rate and a variable interest rate that’s based on inflation (that’s what the I in I bonds stands for). The composite rate is calculated using the formula below.

Composite rate = [fixed rate + (2 x semiannual inflation rate) + (fixed rate x semiannual inflation rate)]

Series I Savings Bonds earn the fixed rate for however long you hold the bond. The inflation rate is what changes. However, fixed rates are currently set at 0% so if you purchase an I Bond now, everything you earn on that bond will be tied to inflation.

That said, because inflation is on the rise right now, I Bonds are a low-risk investment with a huge return (as far as traditional investments go). As you earn interest, this is added to the principal for as long as you hold the bond or for the next 30 years (whichever comes first).

“I bonds are savings bonds put on sale by the US Treasury to protect your cash from losing value due to inflation,” says Sara Graves, founder of USTitleLoans. Kind of like those Beanie Babies in your closet.

What is the Interest Rate For I Bonds?

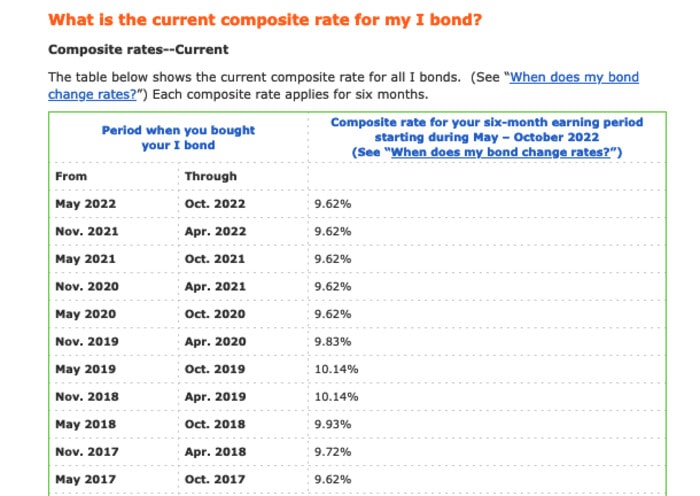

The Treasury Department sets the fixed and inflation rate twice each year. The current two combine to give Series I Savings Bonds a composite rate of 9.62%, which lasts through October 2022.

The Treasury Department will set a new one on the first business day in November based on the inflation rate at that time.

If inflation goes up, the interest rate of I bonds increases. If it goes down, the interest rate decreases. The Treasury Direct site also mentions that, “If the inflation rate is so negative that it would pull the combined rate below zero, we don’t let that happen. We stop at zero.”

But, just because the Treasury changes the rates, that doesn’t mean the rate you earn changes immediately. The rate that you buy the bond at is good for six months.

“For example, if you buy an I bond on July 1, 2022, the 9.62% would be applied through December 31, 2022,” clarifies the Treasury Direct website.

Once you decide to cash out on your I Bond, you’ll be paid the principal and interest together in one lump sum. “To access the interest, you have to cash in on the bond,” says Graves.

What’s The Downside to Buying I Bonds?

There are a few things you should be aware of before capitalizing on this opportunity to earn nearly 10% interest on your money.

- You can only buy up to $10,000 worth of I Bonds annually via the Treasure Direct site and another $5,000 usings your federal tax refund. “You can buy an extra $5,000 value of I bonds with your tax refund,” says Graves. Side note: if you’re getting $5,000 back on your taxes every year, can we hire you?

- You have to keep your money in the I Bond for at least one year.

- If you remove your money before five years, you lose the previous three months worth of interest. So for example, if you cash in your I Bond after 24 months, you’ll only get the first 21 months worth of interest on it. After five years, there are no penalties.

- You must have a social security number and either be a U.S. citizen, a U.S. resident, or a civilian employee of the United States to be eligible to own an I Bond.

- They can’t be held in a traditional or Roth IRA.

Are Bonds Risky?

Bonds, in general, are a very low-risk investment, which is exactly why Grandma so smartly bought you some all those years ago.

I Bonds won’t ever be worth less than what you paid. Crypto could never.

It’s probably worth noting that I Bonds are issued by the government, so if civilized society ceased to exist, you likely won’t see that money again. But we assume you would have bigger problems at that point, so don’t stress about that too much. Sorry for the sense of impending doom. Tic Tac?

Are I Bonds Taxable?

The interest on Series I Bonds is subject to federal income taxes. There are some exemptions, like if you use them to pay for education expenses, including tuition and fees.

But, they are, as Graves explains, “exempt from state and local income taxes,” which is an advantage over ordinary bonds.

How Do I Buy I Bonds?

To buy I Bonds electronically via Treasury Direct, create an account with TreasuryDirect. Which if you doesn’t sound like a real site, just wait until you see the actual site and see how your taxpayer dollars are being used. Here’s a teaser.

If you want to use your tax return to purchase a bond, you need to fill out Form 8888 when you file your taxes. If you didn’t do that this year and already filed, it’s unfortunately too late.

The good news is that your taxes are already filed. Hip hip hooray!

It’s a little confusing to make an account and buy your first I Bond, so follow these steps and we’ll walk you through it. If you want to run, we can’t help you. We’re not huge cardio fans.

- Go to TreasuryDirect and under “Individuals,” click My Accounts.

- Click “Open an Account.”

- Click “Apply Now.”

- Under “Account Type,” choose Individual (unless you’re opening an account on behalf of a business or estate).

- Fill out your personal information, add your bank account details, and click “Submit.”

- Choose a personalized image and add a caption. This is an extra step to keep your account safe so you don’t fall for any scams later.

- Next, choose a password and answer three of the security question prompts. You’ll get an email to confirm your account along with an account number you’ll use to log in, so follow those steps.

- Once you’ve successfully made an account and are logged in, click “Buy Direct” on the top navigation bar.

- Choose “Series I” under “Savings Bonds,” and click “Submit.”

- From there, you’ll add the value you want to buy, and confirm which bank account you’d like to use.

- 25 Summer Wedding Guest Dress Options That *Probably* Won’t Upstage the Bride - July 3, 2024

- 50 Valentine’s Day-Inspired Rooms to Use for Decorating Inspiration - February 9, 2024

- Shake Up One of These 27 Romantic Valentine’s Day Cocktails This Week - January 16, 2024

Leave a Comment